You’ve heard it before and will hear it again, “The biggest mistake new traders make is not following stops.”

You may think following stops means to use fixed stops or limit orders exclusively, but in my experience, market makers take out those stops all the time on low-volume, small-cap stocks. Who are market makers? They are the people running the show. These are the guys or girls who are executing the orders to buy and sell for a given equity at any given time on every exchange.

They see and execute all of the open orders out there and drive the stock to where demand and supply exist. If too much demand exists below the current price, then the price would drop to that level, the stops can be taken out, and then the price bounces back due to simple supply and demand. Think about it…

If a stock isn’t trading well with much volume at the current price, the person running the trade will go to the next level of demand, regardless of whether it’s higher or lower than the current price. If everyone has stops at a lower level, the price will trade there, fill those orders, and then continue to a new level.

So how does a trader follow stops and avoid losing out on a position that is going to bounce back?

The answer is simple – by using mental stops.

For starters; mental stops are NOT limit stop orders executed by an automated program. They are mental, unexecuted orders on when to get out of a losing position. A trader comes up with these before entering a position and keeps this exit position in mind while holding the position.

Mental stops inherently allow you the flexibility to either follow or not follow the order. Intuitively, you may say, well doesn’t that defeat the purpose? Doesn’t that say, well I might not get out at that price and suffer more losses?

Yes and no. If you know how to effectively employ mental stops, their fundamental adjustability allows you to strategically manage your positions and avoid stopping out prematurely.

Getting out at a mental stop loss or not comes down to three things:

- Support levels near the drop.

- The volume when it drops.

- The news around why it dropped.

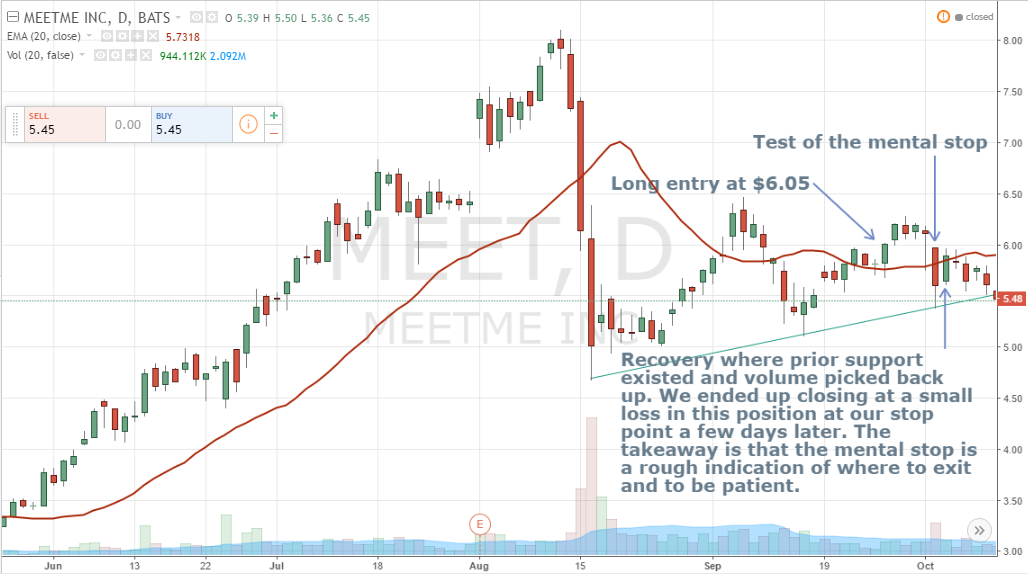

A member of our trade alert service – Daily Profit Machine – sent me a question about mental stops earlier this month. The question essentially boiled down to why I held on to MeetMe Inc. (MEET) after it dropped well below the mental stop I had originally placed at $5.65.

In order to determine whether to actually get out at the mental stop I had originally placed, I simply considered the three factors above.

Firstly, MEET dropped, but it did so after positive news of an acquisition. It hit significant support and it dropped right at the beginning of the day on high volume – but the day before it did the same thing and recovered throughout the remainder of the day. The significant volume right at the drop in the first 30 minutes was probably someone exiting the position, but overall, the day’s average wasn’t too high.

When these three things happened, I saw that there wasn’t a real reason for the drop and held onto the position which recovered quickly. Playing devils advocate for a minute; if MEET released horrible news and then the drop occurred and we blew through the mental stop loss price, I would have exited.

We actually ended up closing at a small loss in this position at our stop point a few days later, but we were able to analyze current data in order to make this decision, rather than using an automated stop based on old information.

The takeaway is that using limit orders makes sense and has a place in trading, but we use mental stops to protect ourselves and prevent stopping out prematurely. Discipline is the key here and what any trader of any background needs to practice consistently.

Learn more about Investing Shortcuts’ Daily Profit Machine trade alert service today. Click below to join this free training and discover how to make up to 100% more in annual returns!